Growing Places Fund

The Growing Places Fund (GPF) loan scheme is a £730m Government-backed national investment fund, put in place specifically to assist stalled transport and infrastructure projects that will boost the local economy, create jobs and build houses.

GPF loans are allocated through the LLEP to schemes that will accelerate the building of homes, office and commercial development space such as site access/site clearance, broadband and transport infrastructure, utilities, refurbishment of buildings and flood defence barriers.

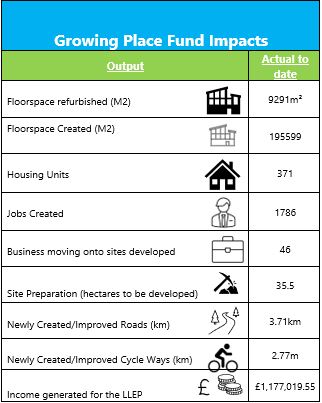

A total of £17.5 million has been loaned in our area, which to date has yielded the following outputs:

GPF loans have contributed to the following projects:

- Donnington Park Formula E

- Optimus Point (3 investments)

o Off site road infrastructure – adjoining road infrastructure

o Roundabout to access site

o Onsite infrastructure – access roads and utilities - Leicester Waterside Project

- Velodrome Site

- Abbey Quarter

- Ashton Green

- The Gresham

- Old Dalby Enterprise Village Melton – (completion due January 2023)

The LLEP offers GPF on a revolving basis, subject to the value of previous loan repayments being available, Applications are invited from developers, local authorities and other applicants in Leicester and Leicestershire.

GPF Eligibility Criteria

- Investment is capital, not revenue. It can be defined as money spent on constructing, acquiring or maintaining fixed assets, such as land, buildings and equipment, all in support of facilitating business and commercial activity.

- The minimum loan amount is £500,000. There is no maximum, but individual loans of £4m or above will need to demonstrate exceptional economic impacts.

- The entire loan (plus interest) must be repaid within a maximum of 5 years from award date or preferably sooner (3 to 4 years).

- The loan will be required to be compliant with current State Subsidy regulations. Interest rates calculated according to investment risk and collateralisation of the loan facility.

- Loans must demonstrate contribution towards the priorities and objectives of the LLEP’s economic strategy.

LLEP Call for GPF Support is Open

The LLEP currently has £10,000,000 of GPF available for new loan investments and is seeking Expressions of Interest (EOI) from eligible schemes. Submission of EOI’s are not subject to a deadline but early applications are encouraged as once the current funds have been committed the call will be closed.